UPDATE FOR 2025:

Check out our NEW automated Medicare Open Enrollment reminder and plan review service called HeyMOE™.

HeyMOE™ takes the hassle, frustration and confusion out of Open Enrollment!

- MOE stands for Medicare Open Enrollment.

- You do not have to remember when Open Enrollment is or how to review coverage options. HeyMOE automatically remembers and does the plan comparison for you!

- You’ll automatically receive a notification in mid-October telling you if your Part D plan is still the best one for you in the coming year or if you could save money by changing plans or pharmacies.

- You’ll have the opportunity to change your prescription medications and pharmacies, if needed.

- This automated reminder and plan comparison service costs just $30 per year, per person.

- HeyMOE does NOT make money from the sale of insurance products. It works for you—not insurance companies.

- New for 2025 — HeyMOE will automatically compare costs using your recommended Part D drug plan to discounts available to you through GoodRx!

- Cancel at any time.

Our Clients Save Thousands Each Year During Medicare’s Open Enrollment Period.

Here’s How to Do It.

Written by Melinda A. Caughill, CSA, Co-Founder, 65 Incorporated

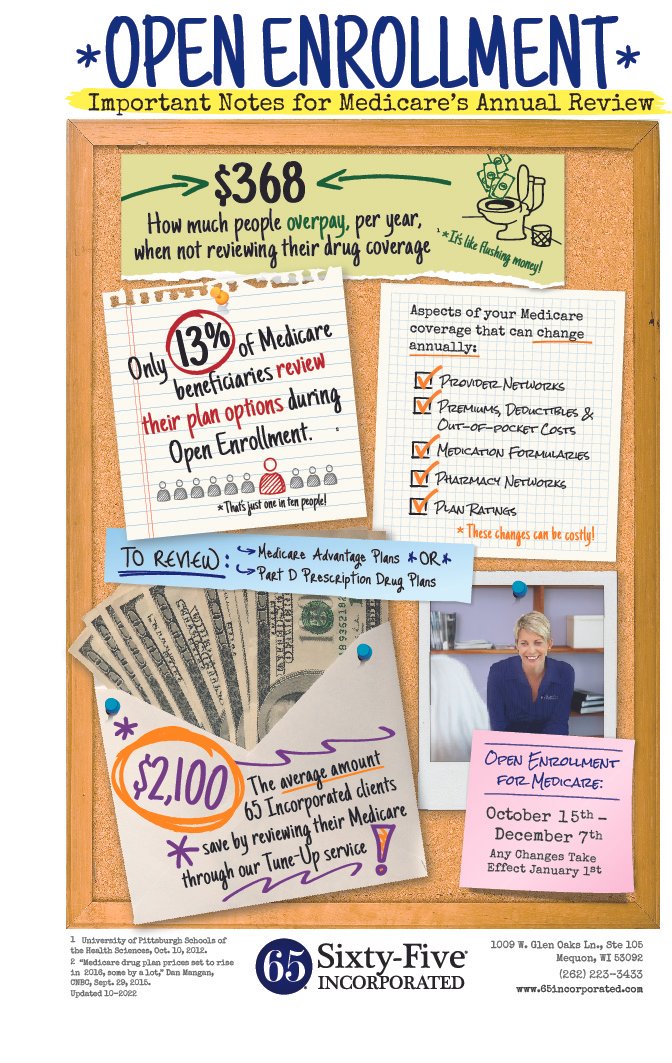

Each year, Medicare Advantage or Part D drug plans can make significant changes for coming year, including monthly premiums, the medications they cover (or do not cover), how much you’ll pay for each drug, pharmacy networks, doctor networks, out-of-pocket costs, deductibles and more. As a result, it’s critical that seniors review their plan options during Medicare's Open Enrollment period between October 15 and December 7 of each year.

Unfortunately, according to a consumer study on Medicare, less than 10% of seniors actually review their Medicare coverage annually. This could be costing you — even thousands or tens of thousands — of dollars. In fact, in 2023, clients of 65 Incorporated getting plan review services saved an average of almost $1,700 each! And, one lucky client saved more than $18,000!

Considering, though, that most people find it painful to review their Medicare coverage, what's the best way to get this information without incurring unnecessary frustration or annoyance?

Triage Your Open Enrollment Needs With 3 Simple Questions

The need to review Medicare coverage is much greater for some people than others. Those who answer yes to any of the following three questions would benefit greatly by reviewing their coverage during Open Enrollment.

Has it been more than 2 years since you last reviewed your Medicare Part D or Advantage plan? The longer it's been since you've reviewed your coverage, the greater the urgency to review your coverage now. The average savings is about $350 per year since the coverage was last reviewed. (Example: 5 years without review equals an estimated potential savings of $1,750.)

Has your health changed since you last reviewed Medicare plans? A change in health usually means that you are seeing new doctors or specialists and/or taking new medications. When people initially pick Medicare plans, they do so based upon their current needs. When those needs change, it's critical to review your coverage. (Example: The senior now has Type 2 Diabetes and takes insulin regularly. The insulin taken is not covered by the current plan costing about $1,500 per month, but it could be covered if the senior switched plans.)

Do you take any brand name medications, or do you take 5 or more medications in general? The more medications that you take, the more likely you are to save money by changing plans for the coming year. But, if you take any brand-named medications (even just one), it's still critical to review your coverage. A single brand-name medication can be thousands or tens of thousands of dollars less on different plans.

4 Ways to Get Assistance with Medicare Plan Reviews

Choose the option that works best for you:

1.

Sign up for HeyMOE — The reminder and review service

HeyMOE™ is reminder and review tool that ensures you always know the best Medicare Part D drug plan for your needs.

» NO remembering dates

» NO confusing comparisons

» NO INSURANCE SALES*

*HeyMOE is a fiduciary service, meaning we work for you! We make no money from the sale of Medicare insurance policies. When you choose HeyMOE, we compare every Part D plan and every pharmacy available. Just sit back and relax knowing you’re getting the best Medicare Part D coverage at the lowest price.

2.

Compare plans using the Plan Finder tool at Medicare.gov.

Can you compare plans yourself? The simple answer is yes. Using the Medicare.gov Plan Finder tool, you can make the decisions that are best for your unique needs. The Medicare.gov Plan Finder tool compares all plans available in an area. It is not affiliated with the sale of any insurance products.

3. Talk to local insurance agents, pharmacies or government resources.

The governement provides Medicare assistance services through local State Health Insurance Assistance Programs (SHIPs). These programs provides free Medicare counseling services provided by volunteers. Please note that the quality and availability of these services vary greatly by location and the specific volunteer you work with.

If you choose to use to compare plans through an insurance agent or pharmacy resource, be sure to understand their business models. Insurance agents are paid a commission when they sell Medicare plans. Thus, many agents will only compare plans that they sell, ultimately limiting your plan options. If you choose to use a pharmacy to compare plans, beware that they will only compare drug prices using their specific pharmacy. Many times, simply changing pharmacies could save you hundreds or even thousands of dollars. Ideally, if you prefer to use an agent or pharmacy to review your plan options, it is ideal to work with multiple agents and pharmacies to ensure the validity of the recommendations.

4.

Learn some basic information about the Medicare Open Enrollment period.

You can find some basic information about Open Enrollment through Medicare.gov. However, if you prefer something more user-friendly, our parent company, 65 Incorporated, offers many free, helpful resources through the library section of their website. Our favorites include the "Open Enrollment Q&A whitepaper and an infographic about the importance of reviewing your coverage during Medicare's Open Enrollment period.

Whichever option you choose, pat yourself on the back. You're doing something that most people enrolled in Medicare never do.

If you discover savings and want to share the good news, let us know! We love to share in the joy of saving money on Medicare.